michigan property tax rates by township

2020 TOTAL PROPERTY TAX RATES IN MICHIGAN Total Millage Industrial Personal IPP COUNTY. The winter tax bill that comes out on December 1st of each year and the summer tax bill that comes out on July 1st of each year.

If you attempt to use the link below and are unsuccessful please try again at a later time.

. 2021-2022 Statutory Tax Collection Distribution Calendar. Ad View County Assessor Records Online to Find the Property Taxes on Any Address. It also provides estimated property taxes for the Plymouth-Canton Wayne-Westland or Van Buren School Districts.

Michigan General Property Tax Act. The Property Tax Calculator is designed to provide tax estimates by multiplying the property values entered and the most current millage rates available. Summer Property Tax Info and Due Dates Village of Schoolcraft Property Tax Info and Due Dates.

Its Fast Easy. Township PoliceFire 1 16147. 33215 Waverly of Total.

Rates include the 1 property tax. Ada Township had a total taxable value of 986136828 in 2018 of which 81 is residential property. We accept cash personal checks bank checks MasterCard Discover and Visa.

Winter Property Tax Info and Due Dates. During the month of March a revised statement from the Township Treasurer must accompany your remittance to the. Property Tax Estimator and Millage Rates.

Winter Tax Rates. Estimate Your Property Taxes Millage Rate Information. January 1 - December 31.

2021 TOTAL PROPERTY TAX RATES IN MICHIGAN Total Millage Industrial Personal IPP COUNTY. The median property tax in Washtenaw County Michigan is 3913 per year for a home worth the median value of 216200. Information regarding personal property tax including forms exemptions and information for taxpayers and assessors regarding the Essential Services Assessment.

On February 14 2022. Michigan Department of Treasury Property Tax Web Portal. This interactive table ranks Michigans counties by median property tax in dollars percentage of home value and percentage of median income.

Yearly median tax in Washtenaw County. The exact property tax levied depends on the county in Michigan the property is located in. 33020 Lansing of Total.

All Remaining Tax Balances - will have 3 penalty added after 430 pm. January 1 - December 31. Taxable Value x Millage Rates 1000 Tax.

The treasurer takes the taxable value established by the assessor and applies the millage rates determined by each government entity involved. Summer Tax Deferment Application. Alcona Alcona Twp 011010 ALCONA COMMUNITY SCH 205369 385369 145369 265369 205369 385369 Caledonia Twp 011020 ALCONA COMMUNITY SCH 195031 375031 135031 255031 195031 375031 Curtis Twp 011030 OSCODA AREA SCHOOLS 209881.

January 1 - December 31. The treasurer is responsible for the billing and collection of the property tax. Beginning March 1 2022 unpaid taxes can no longer be paid at the Township offices and must be paid directly to Robert Wittenberg Oakland County Treasurer 1200 North Telegraph Pontiac Michigan 48341 with additional penalties.

84 rows Minnesota. You can sort by any column available by clicking the arrows in the header row. The calculator can provide estimates for summer taxes winter taxes or both.

181 of home value. Washtenaw County collects on average 181 of a propertys assessed fair market value as property tax. Pittsfield Township has the 3 rd highest population and is one of only two municipalities to be a full-service community while maintaining the 6 th lowest tax rate in Washtenaw County.

Property Tax Estimator and Millage Rates. They are split up into two bills. The list is sorted by median property tax in dollars by default.

February 1 - February 14. This charge is levied by the banks. Township PoliceFire 1 16147.

Michigan has 83 counties with median property taxes ranging from a high of 391300 in Washtenaw County to a low of 73900 in Luce CountyFor more details about the property tax rates in any of Michigans counties choose the county from the interactive map or the list below. There is a 395 charge for debitcredit card use under 160 and a 25 charge for credit card payments over 160. Washtenaw County collects the highest property tax in Michigan levying an average of 391300 181 of median home value yearly in property taxes while Luce County has the lowest property tax in the state collecting an average tax of 73900 086 of median home value per year.

Property owners can calculate their tax bill by multiplying their taxable value by the millage rate. 2019 TOTAL PROPERTY TAX RATES IN MICHIGAN Total Millage Industrial Personal IPP Cheshire Twp 031030 ALLEGAN PUBLIC SCHOOL 331401 511401 271401 391401 331401 511401 BLOOMINGDALE PUBLIC S 315733 495643 255733 375643 315733 495643 Clyde Twp 031040 FENNVILLE PUBLIC SCHO 293224 473224 233224 353224 293224 473224. January 1 - December 31.

The second confusing part of Michigan property taxes is how they are collected. Alcona Alcona Twp 011010 ALCONA COMMUNITY SCH 205108 385108 145108 265108 205108 385108 Caledonia Twp 011020 ALCONA COMMUNITY SCH 194740 374740 134740 254740 194740 374740 Curtis Twp 011030 OSCODA AREA SCHOOLS 213356. If you need additional information regarding your property taxes you can call the Treasurers office at 7346750052 Monday through Friday 800 am 430 pm.

Michigan winter taxes - Michigan summer taxes. The Michigan Department of Treasury updates millage rates annually based on the last years approved L-4029 forms submitted by the taxing units. This tool provides reasonable estimates not actual data.

2022 Property Tax Calendar. Washtenaw County has one of the highest median property taxes in the United. Winter Tax Bills - Are mailed out by December 1 and are payable at the Township offices without penalty until 430 pm.

Total taxable value per capita is 67878 based on a population of 14528 residents. Property Tax Estimator Notice. How Your Tax Dollars Are Distributed.

Summer Tax Deferment Information. 33070 Holt of Total. Download a Full Property Report with Tax Assessment Values More.

Township PoliceFire 2 05561. Median property tax is 214500. The Pittsfield Township 2019 Total Tax Rate of 64381 breaks down in the following way.

The property tax rate in Michigan is referred to as a millage and its figured in mills. The Michigan Treasury Property Tax Estimator page will experience possible downtime on Thursday from 3PM to 4PM due to scheduled maintenance. Summer and winter taxes are billed July 1 and December 1 and are payable without penalty September 14 and February 14.

Tax Bill Information Macomb Mi

Taxes The Treasurer Village Of Pinckney

What Do Your Property Taxes Pay For

Which Kalamazoo County Communities Pay The Highest Property Taxes Mlive Com

Property Taxes In Grand Rapids Mi Grand Rapids Mi Homes For Sale

How To Calculate Michigan Property Taxes On Your Investment Properties

Analysis Detroit Enjoys Highest Per Capita Revenue In State Thanks To High Diversified Tax Rates Mlive Com

Livonia Michigan Property Taxes

Winter Tax Bill Example Macomb Mi

Welcome To Gaines Charter Township

50 Communities With Michigan S Highest Property Tax Rates Mlive Com

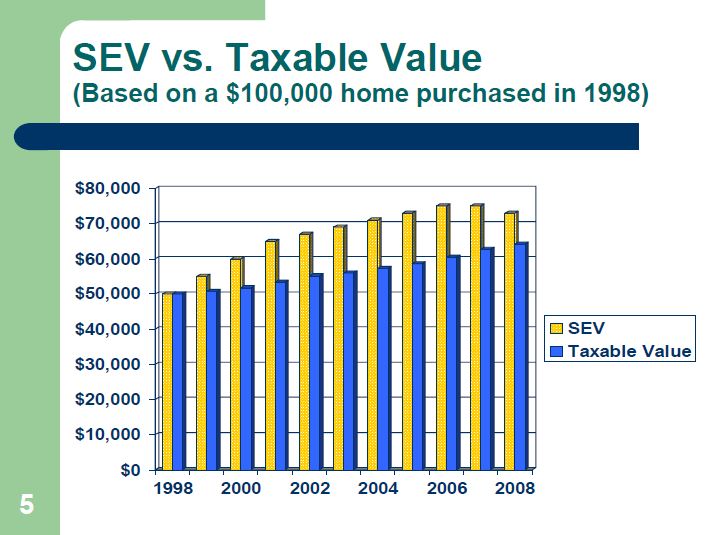

Why Property Taxes Go Up After Buying A Home In Michigan

Michigan Property Tax H R Block

States With The Highest And Lowest Property Taxes Property Tax States High Low